Welcome to visit our website.

202475 · Import procedures have to be followed in order to clear goods as per the East African Community Customs Management Act (EACCMA) 2004. Imports to Tanzania are subjected to different stages whereby the importer is advised to make declaration through his Clearing and Forwarding Agent by lodging documents at least 7 days before …

view more

2022129 · The import of Gold is authorized through recognized agencies of RBI and DGFT. Refineries can import silver ore by obtaining a license with AU regulations. The Code Specifying the Item – 7106 9210 specifies the silver, plated with Gold or platinum in the form of the semi-manufactured sheet, plates, tubes, strips, and pipes.

view more

2017218 · This article explains the common rules and regulations of Indian Customs Alcohol Allowance and Duty required to be paid.

view more

2023824 · As a major hub for international travel, Dubai Airport has implemented strict procedures for the import and export of gold. These measures are in place to prevent illegal activities such as money laundering and the financing of terrorism.

view more

202175 · Saudi Arabia has amended its rules on imports from other Gulf Cooperation Council countries to exclude goods made in free zones or using Israeli input from preferential tariff concessions, in a ...

view more

The main import costs are Basic Customs Duty (BCD), Integrated Goods and Services Tax (IGST), and Social Welfare Surcharge (SWS). You’ll pay IGST on all imports into India - there may also be other taxes including Countervailing Duty (CVD) and Anti-Dumping Duties, depending on the situation.

view more

2023713 · India on Wednesday restricted imports on plain gold jewellery, as the world's second-largest consumer of the precious metal tries to plug loopholes in its trade policy.

view more

Oman Customs - Things to know about border customs clearance UAE and Oman. The procedures for Border Clearance services UAE import and export.

view more

2019122 · Dubai Free Zones – Import and Export Procedures. Dubai has transformed itself into a logistics hub in the Middle East. It has easy access to the markets worldwide. Hence, Investors are preferring Dubai Free Zone for their trading, import, and export operations. Also, the zero corporate taxation, zero customs duty, and 100% foreign …

view more

2024430 · Conclusion: The Customs Act, 1962, serves as a robust legal framework for combating gold smuggling cases in India. The legislation, combined with effective enforcement and collaboration between various agencies, plays a crucial role in deterring and prosecuting those involved in illicit activities related to the import and export of gold.

view more

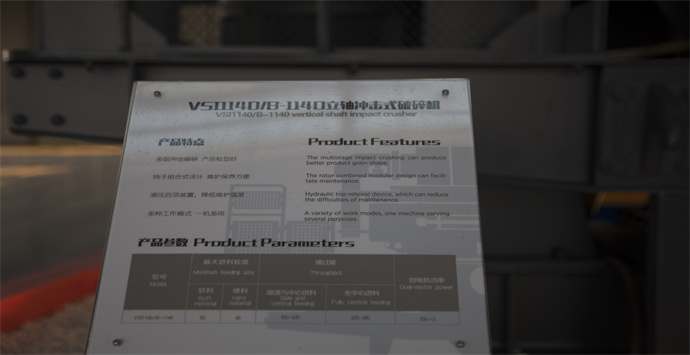

Based on over 30 years' experiences in design, production and service of crushing and s

GET QUOTE