Welcome to visit our website.

2012825 · Some of these fundamental aspects are supply and demand, the value of the dollar, the amount of institutional buying and/or selling, the price difference/relationship between gold and oil, and lastly, and sometimes most importantly, the global economic market. Supply and demand is probably one of the easiest gold fundamentals to …

view more

2 · Chinese gold demand stems from its cultural and financial value. Explore the sources of demand and the prospects for gold in China in this report.

view more

3 · Gold has been present in Chinese history since the Han Dynasty (206 BC-220 AD), but Chinese gold demand took hold during the Six Dynasties (222-589 AD) with the arrival of Buddhism. Worshippers made gold offerings, and built golden pagodas and statues of the Buddha. Today, China is the world’s largest single market for gold, driven by a ...

view more

2020329 · This document analyzes the demand and supply of gold in the Indian market. It discusses that gold demand in India primarily comes from jewelry, investments, and technology. India meets most of its gold demand through imports as domestic production is low. The high cost of gold imports negatively impacts India's current account …

view more

4 · Microeconomics - Practice Test 03: Supply and Demand. The accompanying supply and demand graph represents a hypothetical market for spaghetti pasta. Demonstrate how an increase in the price of penne, a different type of pasta, and a decrease in the price of meatballs will affect the supply and demand of spaghetti pasta.

view more

20191211 · To understand the price of gold, first, one needs to understand the true nature of its supply and demand dynamics.

view more

2022624 · The gold price hit a 19-month high of around $2,039 per ounce in early March and has since stabilized at around $1,900/oz. Global gold mined supply is forecast to increase approximately 4.6% year over year in 2022. According to S&P Global Market Intelligence's new monthly Commodity Briefing Service: Gold report, sentiment for gold …

view more

20231031 · Total Q3 gold supply rose 6% y/y; mine production reached a quarterly record. Higher mine production and recycling contributed to a y-t-d total supply of 3,692t. Q3 saw strength across all components of supply. Mine production reached 971t – an all-time third quarter high in our records back to 2000 – and recycling increased 8% y/y to 289t.

view more

202355 · Q1 gold demand (excluding OTC) was 13% lower y/y at 1,081 tonnes (t). Inclusive of OTC, total gold demand strengthened 1% y/y to 1,174t as a recovery in OTC investment – consistent with investor positioning in the futures market – offset weakness in some areas. 1. Demand from central banks experienced significant growth during the …

view more

In the relation of gold the demand cannot affected or doesn’t matter of price, demand and supply because it is luxurious product and they always usable for functions and many of areas. The price of gold is increases demand then the demand and supply also occur in positive range. The term can be movable as follows:-.

view more

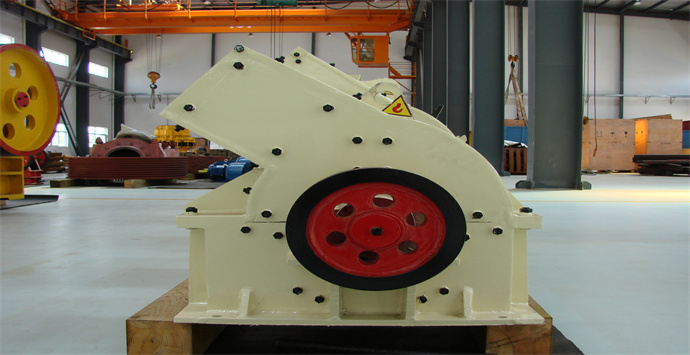

Based on over 30 years' experiences in design, production and service of crushing and s

GET QUOTE