Welcome to visit our website.

Eligibility Criteria For VAT Registration In Pakistan A company seeking VAT registration must be a supplier of taxable goods or services within Pakistan, boast an annual turnover exceeding PKR 50 million, and possess a fixed place of business in the country.

view more

202398 · Register online through ROS You, or your tax agent, can register your business for Value-Added Tax (VAT) through Revenue Online Service (ROS). To avail of this facility, your business must be established in the State.

view more

2021310 · Learn how to register your small business for VAT, what are the benefits and obligations, and how to use eFiling to manage your tax types.

view more

2024118 · Goods and services tax (GST) (Required for most businesses) GST registration is compulsory if: your business or enterprise has a GST turnover of $75,000 or more. your non-profit organisation has a GST turnover of $150,000 or more. you provide taxi or limousine travel including ride-sourcing services for a fare.

view more

1 · Stamp Duty and Property/Flat Registration Charges in Karnataka Buying a property in any Indian state mandates an individual to pay stamp duty and property registration charges. This amount is collected against any immovable and movable assets.

view more

5 · For companies operating across the European Union (EU), there may be a requirement to register their business with a VAT number in another EU country. Once the obligation to VAT register has been established, the process can begin. Find out how to get VAT registered.

view more

How do you register for VAT? Two-Tier VAT registration. Registration for groups. Registration for farmers and agricultural services. Registration for non-established traders. Registration for liquidators, receivers and mortgagees in possession. Registration for State bodies. Cancelling your VAT registration. Registration for charities.

view more

VAT (Value Added Tax) is a tax added to most products and services sold by VAT -registered businesses. Businesses have to register for VAT if their VAT taxable turnover is more than £90,000. They ...

view more

Many startups begin their venture without any proper documentation or company registration. This leads to confusion in addition to a lot of risk of increased liability. Entrepreneurs tend to create a format structure of incorporation of private limited company in Bangalore, Karnataka in order to capitalize on various advantages.

view more

4 · VAT is an indirect tax on consumption charged on value added to taxable supplies at different stages in the chain of distribution. In Uganda, VAT is imposed on the supply of goods and services (taxable supplies) made by a taxable person, other than exempt supplies; and imports other than exempt imports. (Visited 4,149 times, […]

view more

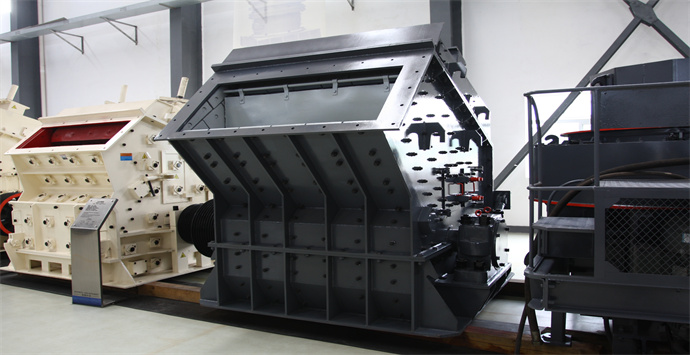

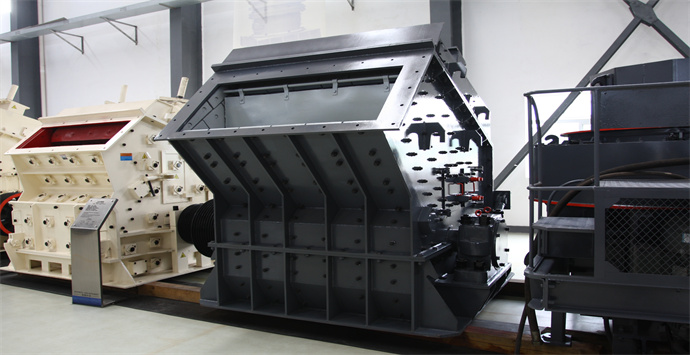

Based on over 30 years' experiences in design, production and service of crushing and s

GET QUOTE