Welcome to visit our website.

All Industries: Average Industry Financial Ratios for U.S. Listed Companies. These ratios are calculated for publicly traded U.S. companies that submit financial statements to the SEC. Hover over the ratio value in the table to see the exact …

view more

202419 · Fisher Gold Bug Pro – Best for Ground Mineralization. Minelab Gold Monster 1000 – Best for Beginners. Fisher Gold Bug – Most Affordable Option. Minelab GPZ 7000 – Professional Gold Metal Detector. Fisher Gold Bug 2 – Best High-Powered Option. 1. Garrett AT Gold – Best Metal Detector for Gold. Check Amazon Price.

view more

Metal Mining Industry's current Price to earnings ratio has increased due to share price growth of 18.98 %, from beginning of the first quarter 2024 and due to net income for the trailing twelve month period contraction of -12.34 % sequential, to Pe of 121.17, from the average Price to earnings ratio in the fourth quarter 2023 of -23.27.

view more

Get Bata India latest Key Financial Ratios, Financial Statements and Bata India detailed profit and loss accounts. ... MARKET ACTION Dashboard F&O ... Gold Rate. Nifty 50. 24323.85 +21.70 (+0.09% ...

view more

2023516 · 1. Volume 38 C. Reichl, M. Schatz Minerals Production . Vienna, 2023 World Mining Data 2023 Iron and Ferro-Alloy Metals Non-Ferrous Metals Precious Metals

view more

2 · Investors are optimistic on the American Metals and Mining industry, and appear confident in long term growth rates. The industry is trading at a PE ratio of 33.4x which is higher than its 3-year average PE of 14.7x. The 3-year average PS ratio of 1.3x is lower than the industry's current PS ratio of 1.6x. Past Earnings Growth.

view more

2024619 · For example. the debt-to-asset ratio for 2022 is: Total Liabilities/Total Assets = $1,074/3,373 = 31.8%. This means that 31.8% of the firm's assets are financed with debt. In 2023, the debt ratio is 27.8%. In 2023, the business is using more equity financing than debt financing to operate the company.

view more

2023102 · A $1,500/oz gold assumption will result in a much lower valuation versus $2,000/oz gold. Investors need to build a price deck forecasting where they see metals trading over the next 5-10 years. In today's environment, many experts see gold averaging $1,800-$2,000/oz or more over the next decade given high inflation and global uncertainty.

view more

Avino Silver and Gold Mines Ltd : 4 Q: 29.67 : 2.54 : 1023.47 : 1.05 : Anglogold Ashanti Plc: 4 Q - 2.34 : 2.56 ... Quarter 2024 for Metal Mining Industry, Price to Sales ratio is at 2.2, Price to Cash flow ratio is at 5.37, and Price to Book ratio is 2.16 More on Metal Mining Industry Valuation: At a Glance ...

view more

2024226 · Ratio Analysis: A ratio analysis is a quantitative analysis of information contained in a company’s financial statements. Ratio analysis is used to evaluate various aspects of a company’s ...

view more

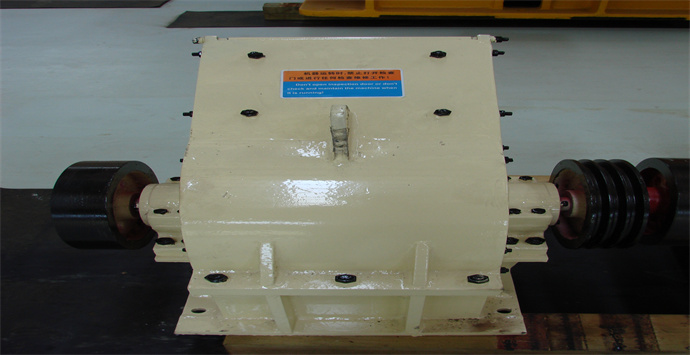

Based on over 30 years' experiences in design, production and service of crushing and s

GET QUOTE