Welcome to visit our website.

Earn up to 9.40%* p.a. with a Fixed Deposit (FD) at Shriram Finance, Including 0.50%* p.a. for Senior Citizens and 0.10%* p.a. for Women Depositors.

view more

202475 · Tax-saving fixed deposit (FD) account is a type of fixed deposit account that offers a tax deduction under Section 80C of the Income Tax Act, 1961.

view more

A minimum deposit of Rs. 25,000/- is all what you need to open a fixed deposit account. If you are a Sampath Bank account holder, then the interest earned, whether monthly or annually, can be automatically transferred to your Current or Savings account according to your wishes. Sampath Bank branches with special limits for minimum deposits:

view more

2023126 · The interest rate ranges for this scheme from 3.00% to 7.00% for the general public and 3.50% to 7.75% for Senior Citizens. HDFC Bank Health Cover FD. This FD ensures safety in health and also guarantees a return. The tenure ranges from 1 year to 10 years. The minimum deposit amount can be ₹2 lakhs, and the maximum amount can …

view more

202472 · Punjab National Bank (PNB) offers FD interest rates of 3.50-7.25% p.a. to the general public on tenures ranging from 7 days to 10 years.

view more

2 · HNB Bank offers high interest rates on fixed deposits for general and senior citizens, providing the flexibility to choose the deposit period according to their specific needs. Open a fixed deposit account today!

view more

2020817 · FD Calculator: Find out how much do you earn through a Fixed Deposit by using Goodreturns fixed deposit calculator. Check FD interest rate of all banks by maturity period, deposit amount & fixed ...

view more

202472 · Gain clarity on income tax implications related to fixed deposit interest. Learn about taxation rules, deductions, and more.

view more

20191231 · Compare all fixed deposit offers of taka 100000 provided by banks in Bangladesh. Find maximum profits and grab the best offer suitable for you.

view more

202298 · Fixed deposits is one of the most popular investment options in India. Based on the interest pay-outs, there are two types of fixed deposits - cumulative FDs and non-cumulative FDs. Which one should you choose for which need? Know here

view more

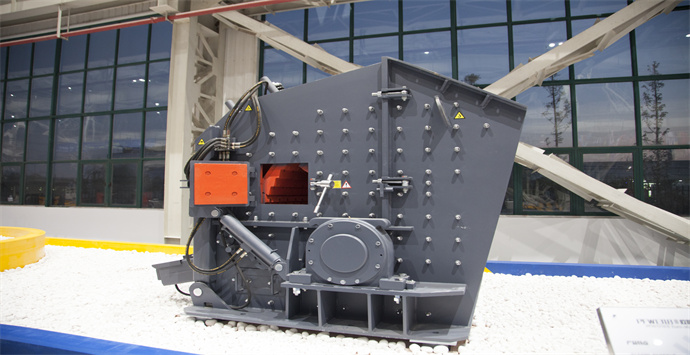

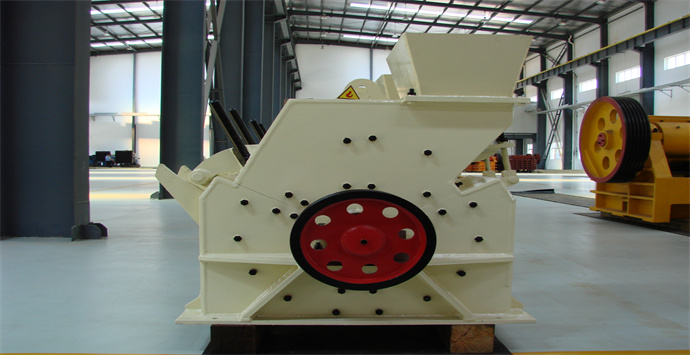

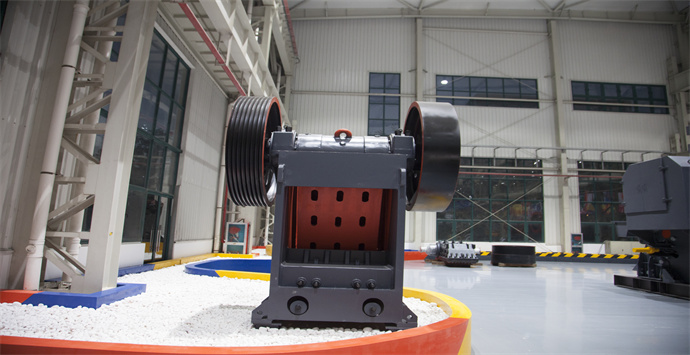

Based on over 30 years' experiences in design, production and service of crushing and s

GET QUOTE