Welcome to visit our website.

202449 · Discover what depreciation is, examine how it can help you make buying decisions and learn four methods to calculate it with examples for each calculation.

view more

2 · Classes of depreciable property To calculate capital cost allowance (CCA) on your depreciable properties, use the form that applies to your business: Form T2125, Statement of Business or Professional Activities Form T2042, Statement of Farming Activities Form T2121, Statement of Fishing Activities

view more

Property, plant, and equipment are stated on the basis of cost and include expenditures for new facilities, major renewals, betterment, and software. Normal repairs and maintenance are expensed as incurred. Depreciation of plant, equipment, and software is computed using the straight-line method.

view more

2022413 · How to determine the fair market value of the equipment is important to business owners in California. Knowing your equipment's fair market value (FMV) is vital in understanding your financial position and correctly fulfilling tax obligations. To help you determine this, we’ve identified three valuation methods that Certified Machinery and …

view more

2024529 · Guide to claiming the decline in value of capital assets used in gaining assessable income, such as a car or machinery.

view more

2024228 · Photography equipment is a significant investment for photographers, and it’s important to ensure that they get the most out of their investment. However, as with any investment, equipment will eventually depreciate over time. But how long does it take for photography equipment to depreciate? In this comprehensive guide, we will explore the …

view more

Discover how to accurately calculate the depreciation of IT equipment with FMIS's expert guide. Keep your assets up to date and compliant.

view more

2024417 · Depreciation vs amortisation The term ‘depreciation’ is typically associated with tangible assets like property, plant, and equipment (PP&E), while ‘amortisation’ refers to intangible assets. The requirements for depreciating PP&E are found in IAS 16, whereas IAS 38 deals with the amortisation of intangible assets. Most requirements of these two …

view more

2024615 · Calculate depreciation under the Companies Act, 2013! Learn how to use the WDV method and find useful life for your assets in Schedule II.

view more

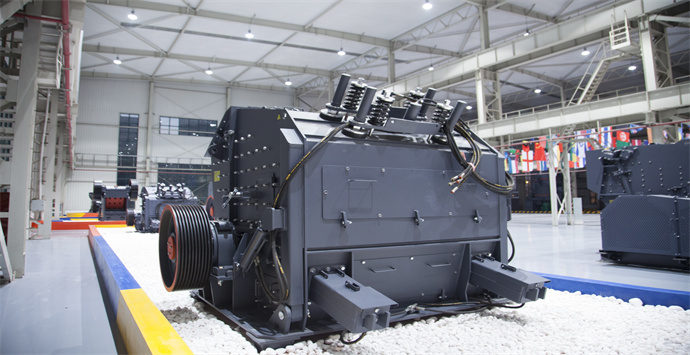

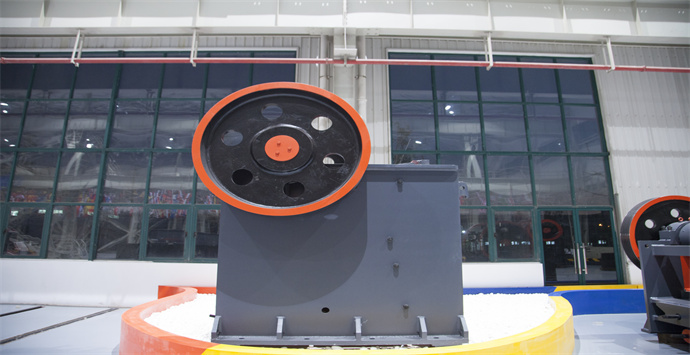

Based on over 30 years' experiences in design, production and service of crushing and s

GET QUOTE