Welcome to visit our website.

4 · Below you can see how royalty payments are accounted for in different countries from a tax perspective. UK. Royalties are part of business income, counting towards annual tax. Individuals receiving royalties must declare earnings on their self-assessment but can make use of the trading allowance of £1000 to reduce the tax burden.

view more

202469 · Deduction in respect of profits and gains from industrial undertakings after a certain date, etc. Section 80i of Income Tax Act 1961

view more

Contribute to sili2023/sbm development by creating an account on GitHub.

view more

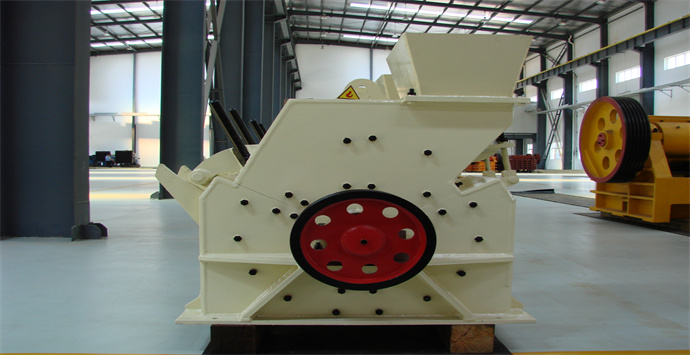

sbm rock crusher photoRock Crusher: Mining Equipment eBay Heavy duty Rock Crusher Frit Maker Professionally designed and manufactured.The plunger weighs 41 pounds and both the sha

view more

In India, royalty income is classified as “Income from Other Sources” and taxed at the individual’s applicable income tax slab rate. For businesses, it is added to the total income and taxed according to the corporate tax rates. This distinction is crucial for taxpayers to accurately determine their tax liability and comply with tax rates.

view more

Income Tax You’ll generally, independent of whether you’re liable for self-employment taxes, be taxed on your royalties at your personal income tax rate. So, how would our freelance writer and lawyer/accountant examples report the royalty income on their tax returns?

view more

2019716 · 3.3 The applicant has to pay advance royalty/seigniorage along with income tax to the mines department. The above royalty will be paid on estimated quantity extraction of big metal. The royalty is Rs.75/- per QM and have to pay 30% of Rs.75/- towards DMF and 2% of Rs.75/-towards merit fund and 2% of Rs.75/ – towards TCS to …

view more

2020918 · TAXATION OF ROYALTIES AND OTHER INCOME FROM INTELLECTUAL PROPERTIES These notes are issued for the information of taxpayers and their tax representatives. They contain the Department’s interpretation and practices in relation to the law as it stood at the date of publication. Taxpayers are reminded that their …

view more

Contribute to dinglei2022/en development by creating an account on GitHub.

view more

Based on over 30 years' experiences in design, production and service of crushing and s

GET QUOTE