Welcome to visit our website.

Step 1. Quary Company is considering an investment in machinery with the following information. Initial Investment $ 227,000 Materials, labor, and overhead (except depreciation) Useful life 9 years Depreciation-Machinery Salvage value $ 20,000 Selling, general, and administrative expenses Expected sales per year 11,350 units Selling price …

view more

Here’s the best way to solve it. Answer A. A …. Quary Company is considering an investment in machinery with the following information Initial investment $ 371.000 Materials, labor, and overhead (except depreciation) Useful life 9 years Depreciation Machinery Salvage value $ 20,000 Selling, general, and administrative expenses Expected ...

view more

Question: Quary Company is considering an investment in machinery with the following information. Initial investment $ 362,000 Materials, labor, and overhead (except depreciation) $ 81,450 Useful life 9 years Depreciation—Machinery 38,000 Salvage value $ 20,000 Selling, general,

view more

Question: Quary Company is considering an investment in machinery with the following information. Initial investment $ 371,000 Materials, labor, and overhead (except depreciation) $ 83,475 Useful life 9 years Depreciation—Machinery 39,000 Salvage value $ 20,000 Selling, general,

view more

Quary Company is considering an investment in machinery with the following information. Initial investment - $209,000 Useful life - 9 years Salvage value - $20,000 Expected sales per year - 10,450 units Materials, labor, and overhead (except depreciation) | Homework.Study.com BusinessFinancePayback period

view more

Question: Quary Company is considering an investment in machinery with the following information. The company's required rate of return is 14%. (PV of $1. FV of $1. PVA of $1. and FVA of $1) (Use appropriate factor (s) from the tables provided.) Initial investment $ 288,000 $ 54,000 Materials, labor, and overhead (except depreciation ...

view more

Quary Company is considering an investment in machinery with the following information. The company's required rate of return is 14\%. (PV of S1, EV of S1.

view more

Indiana has the potential be more than it is now. Indiana has the potential to be a state that incubates and supports young filmmakers and talent. Along with my own journey, it’s my dream to encourage and help other local Hoosier filmmakers. Together, we can build a film industry community. If there’s one thing the last 6 years have taught ...

view more

Question: Quary Company is considering an investment in machinery with the following information. The company's required rate of return is 12%. (PV of $1. FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor (s) from the tables provided.) Initial investment Useful life Salvage value Expected sales per year $ 200,000 Materials, labor, and ...

view more

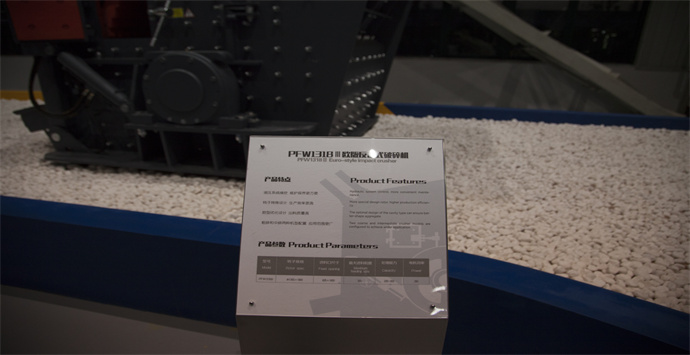

Based on over 30 years' experiences in design, production and service of crushing and s

GET QUOTE